by admin | Mar 14, 2018 | Market Updates, Real Estate Trends

Bay Area homes have gained value year-over-year for a record 70 straight months, according to real estate data firm CoreLogic. Some counties have seen average property values nearly double during that stretch, including appreciation of more than 80 percent in Alameda, Contra Costa, Santa Clara and San Mateo counties. That’s nearly twice the national increase during the same time. In Alameda and Solano counties, real estate offered better returns than even the Dow’s 87 percent run-up between April 2012 and December 2017.

The sheer scarcity of homes for sale is driving up bids. The Bay Area median price for a resold home rose to $712,000 in January, an 11.8 percent gain from a year ago, according to a report released Wednesday by CoreLogic. Houses in hot spots such as Cupertino, Los Altos and Mountain View are going for almost 50 percent over asking price!

The latest sales report from January reflects a steady rise in home prices, pumping up values for property owners while leaving first-time buyers busting budgets to purchase a starter home. Experts say prices were boosted by continued tight inventory and a growing, well-paid workforce.

Click here to read the article.

by admin | Mar 12, 2018 | Market Updates, Real Estate Trends

Mortgage Rates have stayed at roughly the same level for these past 5 day, even after the Jobs reports came out! This is not only uncommon for 2018, but this generally only happens a few times a year.

Reason for lack of movements comes from the much stronger than expected job report, which made bond markets react in a negative way. In other words, bonds suggested that rates should move noticeably higher today. There are two ways to make sense of this. On one hand, yesterday’s bond market movements suggested improvement in rates that never materialized. In that sense, we were “owed,” for lack of a better term. On the other hand, rates are more or less up against their long-term ceiling levels and when that happens, the normal cause and effect between bond markets and rates becomes muted.

From a strategy standpoint, this can be useful. Those inclined to roll the dice with respect to locking their rate could wait to do so until rising rates force their hand. In other words, if rates aren’t eager to move, why bother locking? The only problem there is that rates WILL move soon, and if they move higher, anyone floating would be forced to lock at a loss in order to avoid the additional losses that such a move would imply. Most prospective borrowers have been and continue to be best-served by a defensive stance that favors locking.

Today’s Most Prevalent Rates – 3/09/2018

- 30YR FIXED – 4.5-4.625%

- FHA/VA – 4.375%

- 15 YEAR FIXED – 3.875%

- 5 YEAR ARMS – 3.5-3.75% depending on the lender

Click here to read full article at Mortgage News Daily.

by admin | Mar 1, 2018 | Market Updates, Real Estate Trends

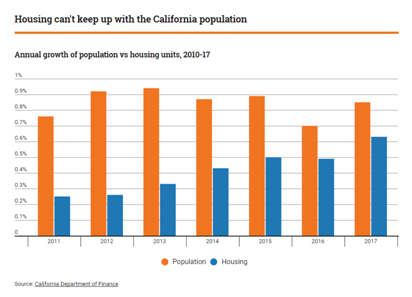

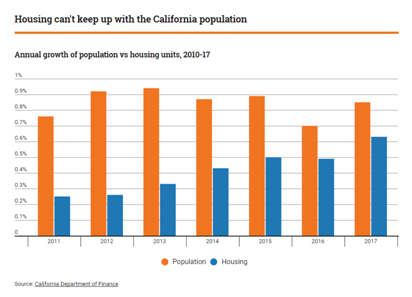

California has been struggling with a housing shortage caused by increasing home prices and shortages of affordable housing. Other factors such as the widespread wild fires all across California have only exacerbated the housing shortage this year. This shortage has left many potential California homeowners stuck renting.

Last year 97.6 percent of California cities did not meet their full housing goals. According to the California Department of Housing and Community Development (HCD), only 13 cities (2.4 percent) met their full goals last year. “California has a huge housing deficit due to years of under-production,” said Senator Wiener in a statement. Senator Wiener has been promoting bill SB 828 in order to “reform the methodology “of how the Regional Housing Needs Allocation goals are calculated. If passed Senator Wiener believes this bill would help alleviate the housing shortage by expecting any city that came up short on its housing goal to make up the difference next year. It would also require provisions that require cities to m eet the needs of lower and middle income residents.

eet the needs of lower and middle income residents.

Click here to read article.

by admin | Feb 20, 2018 | Market Updates, Real Estate Trends

North Bay

Marin County: had 212 recorded homes sold in 2017. This county had experienced a 10.8% change in the median value of home sales, increasing from $857,500 in December 2016 to $950,000 in December 2017

Sonoma County: had 432 recorded homes sold in 2017. This county had experienced a 16.9% change in the median value of home sales, increasing from $526,250 in December 2016 to $615,000 in December 2017

Napa County: had 129 recorded homes sold in 2017. This county had experienced a 12.9% change in the median value of home sales, increasing from $560,000 in December 2016 to $632,500 in December 2017

Solano County : had 612 recorded homes sold in 2017. This county had experienced a 5.1% change in the median value of home sales, increasing from $390,000 in December 2016 to $410,000 in December 2017

East Bay

Alameda County: had 1,472 recorded homes sold in 2017. This county had experienced a 12.9% change in the median value of home sales, increasing from $675,000 in December 2016 to $762,000 in December 2017.

Contra Costa County: had 1,360 recorded homes sold in 2017.This county had experienced a 9.1% change in the median value of home sales, increasing from $504,250 in December 2016 to $550,000 in December 2017.

San Francisco

San Francisco County: had 430 recorded homes sold in 2017.This county had experienced a 6.6% change in the median value of home sales, increasing from $1,100,500 in December 2016 to $1,173,000 in December 2017

Peninsula

San Mateo County: had 563 recorded homes sold in 2017. This county had experienced a 19.1% change in the median value of home sales, increasing from $1,008,000 in December 2016 to $1,200,250 in December 2017.

Silicon Valley

Santa Clara County: had 1,520 recorded homes sold in 2017. This county had experienced a 8.9% change in the median value of home sales, increasing from $805,000 in December 2016 to $658,00,000 in December 2017.

Monterey

Santa Cruz County: had 218 recorded homes sold in 2017. This county had experienced a 8.9% change in the median value of home sales, increasing from $604,500 in December 2016 to $658,000 in December 2017.

San Benito County: had 75 recorded homes sold in 2017. This county had experienced a 8.2% change in the median value of home sales, increasing from $475,000 in December 2016 to $513,000 in December 2017.

Monterey County: had 315 recorded homes sold in 2017. This county had experienced a 14.3% change in the median value of home sales, increasing from $490,000 in December 2016 to $560,000 in December 2017.

To see values throughout California click here.

by admin | Feb 8, 2018 | Real Estate Trends

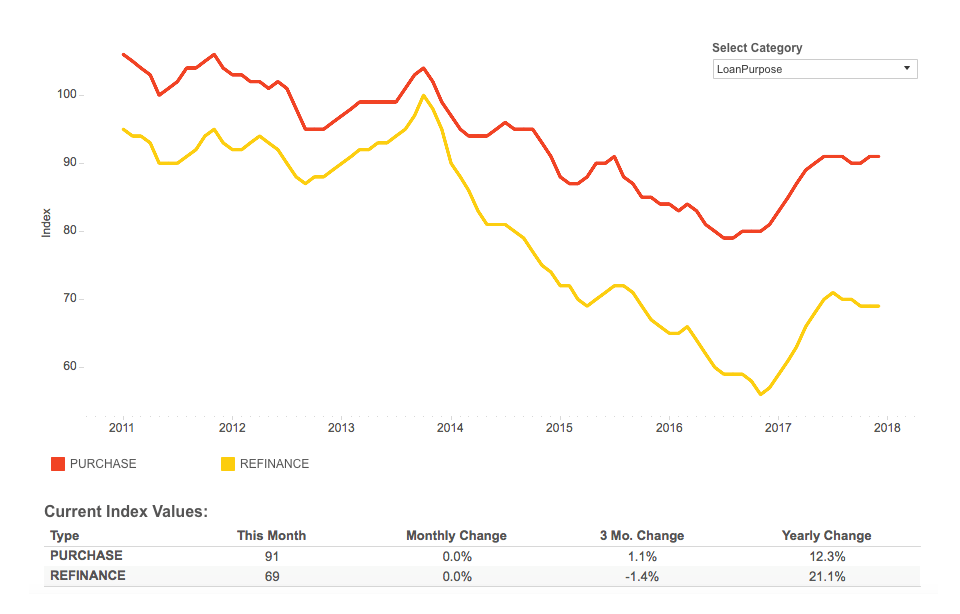

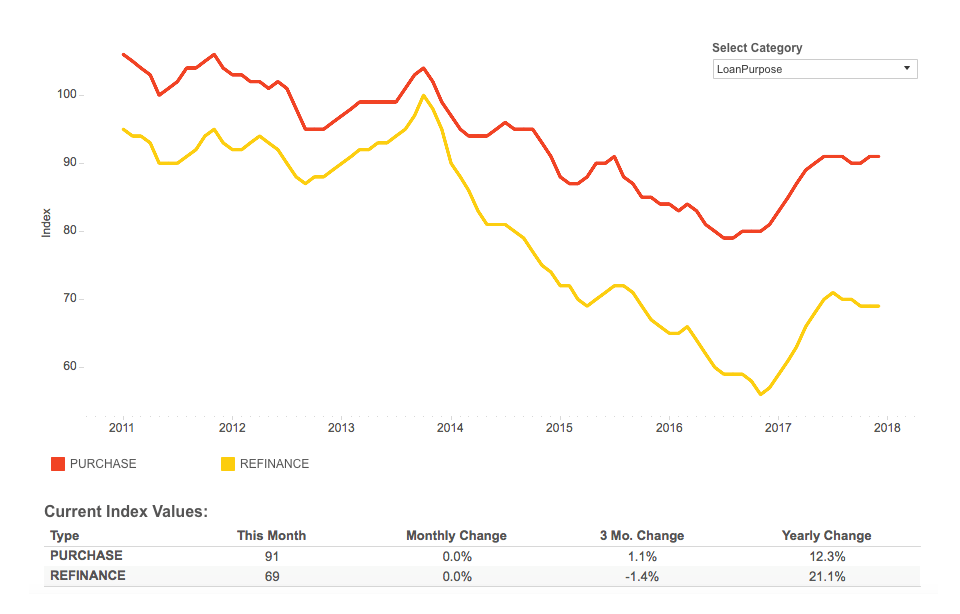

U.S mortgage rates are on the rise, leading to higher defect rates due to more fraud and misrepresentation in mortgage loan applications.“We have seen this before, in 2013, as mortgage rates rise, so does overall defect, fraud, and misrepresentation risk,” said Mark Fleming, Chief Economist at First American. In the last year the defect index has risen 20.3% since December 2017, although the overall defect index is still down 18.6% since its high point in 2013 . The defect idex for refinance transactions rose 21.1% since last year and the purchase transaction rose 12.3% since last year.

As stated in the article, “Much of the elevated risk can be attributed to an increase in the share of purchase mortgage transactions. It’s possible that all economists agree, that mortgage rates will increase in 2018, which should increase the market share of purchase mortgage transactions, putting upward pressure on the overall risk of defect, fraud, and misrepresentation.” The increase in purchase contracts stems from the rise in mortgage rates that have reduced the consumer benefit of refinancing their existing loans. With the rising mortgage rates the share of refinance transactions in overall mortgage transactions is predicted to decline in 2018 leading to more risk and higher a defect index.

Click here to read the article.

by admin | Feb 7, 2018 | Market Updates, Real Estate Trends

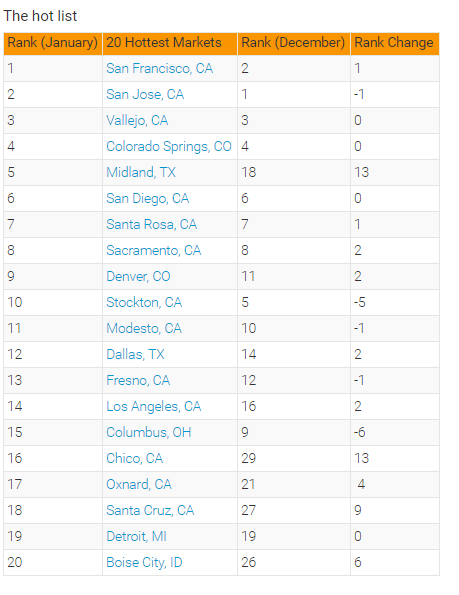

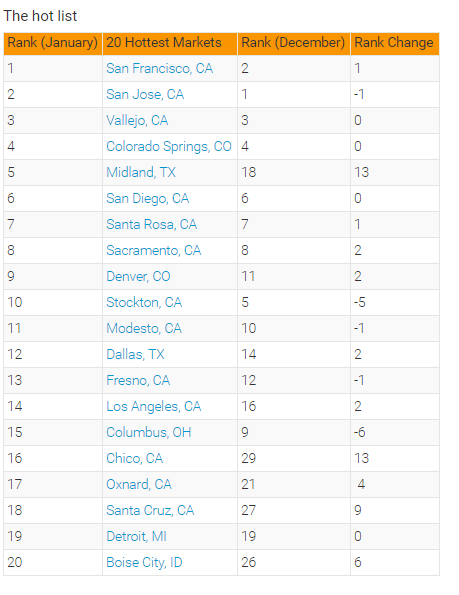

The top three hottest housing markets in the U.S for January are located here in the Bay Area with San Francisco topping the list followed closely by San jose and Vallejo. Other Bay Area markets that made the top of the list this month were Santa Rosa ranked 7th, and Santa Cruz ranked 18 which has moved up 9 spots since last month. A total 13 out of the 20 hottest housing markets in the U.S for January are located in California.

Placement on the list was based on number of listing views in each market and the number of days homes spend on the market. Recent movements and changes on the list can be attributed to, “A strong stock market run, new tax laws, and a government shutdown have given buyers and sellers plenty to digest as they come to terms with the new economic landscape and their personal situation,” said Javier Vivas, director of economic research at Realtor.com. According to data released with the list of hottest housing markets, approximately 365,000 new listings are expected to hit the market in February, showing a 3 percent increase over last year. Click here to go to full article.

by admin | Nov 7, 2017 | Real Estate Trends

Pacific Appraisers is excited to have Ryan Whitelaw, MAI attending the Monterey Bay Economic Partnership 3rd Annual conference on November 8th, 2017. Some of the topics of discussion will be:

- Transforming Our Downtowns: Creating Walkable, Livable Communities,

- Monterey Bay Region: Leading the Way in Employer Sponsored Housing,

- Maximizing the Region’s Transportation Infrastructure

Click here to see more on this upcoming event.

by admin | Jul 28, 2017 | FHA Appraisals, Market Updates, Real Estate Trends

There is a new trend emerging. Foreign investors have increased the percentage of residential real estate purchases by 49% from the previous year. See full article here.

As appraisers we have seen the trend of high investor purchases over the last 8 years but did not have great data as to what extent foreign investors played in this role. It is clear that over the last year they have played a much bigger role than in previous years.

by admin | May 5, 2017 | Real Estate Trends

A partial interest discount is allowable by the IRS when there is less than a 100% interest in the ownership of the Real Estate. This applies to the business entities that own real estate as well. The discount relates to the lack of control over the operation of the real estate and the lack of marketability due to the challenges with selling an interest that is not easily financeable.

Typically, discounts apply to the gifting of a fractional interest or death of an individual that owns a fractional interest in real estate. Discounts for lack of control and marketability have been upheld by the courts and therefore should be considered when valuing a fractional ownership interest. The IRS requires the appraisal to be done by a qualified appraiser.

Pacific Appraisers has experts in both the residential and commercial real estate valuation. For more information or questions please contact Shain Holden at 831-607-3800.

by admin | Apr 11, 2017 | Market Updates, Real Estate Trends

Zillow came out with their median home values over the last year as well as their prediction for what home values will be over the next year. See below:

The median home value in California is $490,100. California home values have gone up 6.9% over the past year and Zillow predicts they will rise 1.5% within the next year. The median list price per square foot in California is $281. The median price of homes currently listed in California is $473,900. The median rent price in California is $2,500. Click here to read the full zillow article.

Page 3 of 7«12345...»Last »