by admin | Apr 24, 2018 | Market Updates, Real Estate Trends

New residents to the Bay Area are earning far more than the people they’re chasing out, pushing up home prices and highlighting the gap between owners and renters in Silicon Valley. Lower income workers moving out of the Bay Area were being replaced by younger workers making about $12,640 more annually from 2005 to 2016, according to a national study released by BuildZoom. The Bay Area income gap has accelerated from 2010 to 2016, with the average newcomer out-earning the typical former resident by about $18,700. Bay Area newcomers had a median annual household income of about $70,000, while those leaving had a household income of $57,400. About 60 percent of the newcomers had at least a four-year college degree, while about 50 percent of the outgoing residents had that level of education.

The Bay Area represents the extreme edge of a national trend: higher paid and educated professionals moving to large, coastal cities like San Francisco and New York, while lower paid workers are moving toward less expensive metro areas. This migration has driven up housing prices in coastal cities, while others in the Rust Belt have seen home prices drop.The median sale price for a single-family home in prime Bay Area counties has climbed for nearly six years. The median price for a home in Santa Clara County in February was $1.3 million, in Alameda County $750,000, in San Mateo County $1.45 million and San Francisco $1.5 million, according to real estate data firm CoreLogic

by admin | Apr 18, 2018 | Market Updates, Real Estate Trends

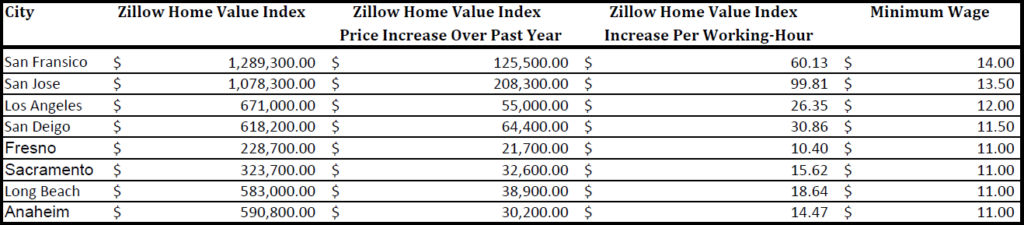

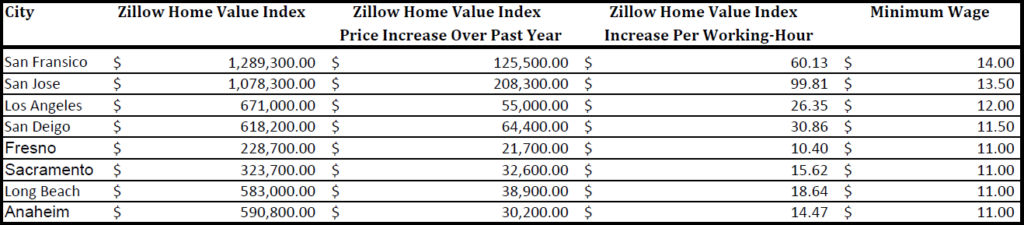

Houses in San Francisco earn more per hour than most of their owners – or anyone else, for that matter, – do at work, a new report finds.A study released by real estate site Zillow finds that houses in the Bay Area city typically appreciate at a rate of $60.13 for each working hour, calculated based on a 40-hour work week. Minimum wage workers in San Francisco currently take home $15 an hour and the average hourly wage in the San Francisco-San Mateo metro area was $36.61 in 2016, reported the U.S. Department of Labor.

In San Jose, the typical homeowner is gaining $99.81 of equity in their home every working-hour, but minimum wage in the city is just $13.50. That means the typical home in San Jose is “earning” over seven times local minimum wage. Even still, the average hourly wage in the San Jose metro is $43.71, which is over two times less than local home value appreciation per working-hour.

San Francisco and San Jose are poised to be among the most expensive markets in the nation throughout 2018, reported Zillow, with median home values of $1.1 million in San Jose and $893,000 in San Francisco. A renter or prospective buyer would need to earn at least $170,000 a year to live comfortably in either market, according to HSH.com.“The way the economy in the Bay Area is right now, it’s like the demand is on steroids,” Michael Rawson, director of the Public Interest Law Project based in the Bay Area, told Newsweek. “It drives the land prices through the roof.”

Click here to read full article.

by admin | Apr 12, 2018 | Market Updates, Real Estate Trends

A house that suffered major fire damage two years ago is on the market for $800,000 in San Jose, California. The listing, which has already attracted criticism online, would appear to be a clear example of Silicon Valley’s overheated housing market.

But the realtor behind the sale has defended the asking price, telling local media that the area and the land itself warrants it. The dilapidated and boarded-up house sits on a 5,800 square foot lot in San Francisco’s Bay Area, home to some of the country’s largest tech firms and start-ups. According to real estate company Zillow, the median home value in San Jose is $1,078,300. That’s up 23.9% over the past year, and is predicted to rise 8.4% over 2018. The fact that severe fire damage only bumped that average down to $800,000 says a lot about the area’s market, where available housing is sparse and residents prioritize proximity to their employment.

A post Monday on the Willow Glen Charm page on Facebook lists a $799,000 asking price. Barr told KTVU she’s already received at least 10 offers and expects to sell the property in the next few days.

Click here to read the full article.

by admin | Mar 14, 2018 | Market Updates, Real Estate Trends

Bay Area homes have gained value year-over-year for a record 70 straight months, according to real estate data firm CoreLogic. Some counties have seen average property values nearly double during that stretch, including appreciation of more than 80 percent in Alameda, Contra Costa, Santa Clara and San Mateo counties. That’s nearly twice the national increase during the same time. In Alameda and Solano counties, real estate offered better returns than even the Dow’s 87 percent run-up between April 2012 and December 2017.

The sheer scarcity of homes for sale is driving up bids. The Bay Area median price for a resold home rose to $712,000 in January, an 11.8 percent gain from a year ago, according to a report released Wednesday by CoreLogic. Houses in hot spots such as Cupertino, Los Altos and Mountain View are going for almost 50 percent over asking price!

The latest sales report from January reflects a steady rise in home prices, pumping up values for property owners while leaving first-time buyers busting budgets to purchase a starter home. Experts say prices were boosted by continued tight inventory and a growing, well-paid workforce.

Click here to read the article.

by admin | Mar 12, 2018 | Market Updates, Real Estate Trends

Mortgage Rates have stayed at roughly the same level for these past 5 day, even after the Jobs reports came out! This is not only uncommon for 2018, but this generally only happens a few times a year.

Reason for lack of movements comes from the much stronger than expected job report, which made bond markets react in a negative way. In other words, bonds suggested that rates should move noticeably higher today. There are two ways to make sense of this. On one hand, yesterday’s bond market movements suggested improvement in rates that never materialized. In that sense, we were “owed,” for lack of a better term. On the other hand, rates are more or less up against their long-term ceiling levels and when that happens, the normal cause and effect between bond markets and rates becomes muted.

From a strategy standpoint, this can be useful. Those inclined to roll the dice with respect to locking their rate could wait to do so until rising rates force their hand. In other words, if rates aren’t eager to move, why bother locking? The only problem there is that rates WILL move soon, and if they move higher, anyone floating would be forced to lock at a loss in order to avoid the additional losses that such a move would imply. Most prospective borrowers have been and continue to be best-served by a defensive stance that favors locking.

Today’s Most Prevalent Rates – 3/09/2018

- 30YR FIXED – 4.5-4.625%

- FHA/VA – 4.375%

- 15 YEAR FIXED – 3.875%

- 5 YEAR ARMS – 3.5-3.75% depending on the lender

Click here to read full article at Mortgage News Daily.