by admin | Aug 10, 2018 | Market Updates, Real Estate Trends

State lawmakers are now making moves to alleviate California’s soaring rents and home prices. The bills being deliberated cover permanent housing for the homeless, new zoning rules to allow apartments on BART parking lots, and workarounds for the $10,000 federal cap on state and local tax deductions.

Assembly Bill 2162 would fast-track housing developments for the homeless and disabled that can be delayed or derailed by local politics. The bill would also allow for affordable leases on apartments.

Assembly Bill 2923 aims to allow housing development on BART’s parking lots. David Chiu, who leads the Assembly’s housing committee, states that “Given the twin housing and congestion crises, building housing next to major transit is simply common sense.” However, this bill faces stiff opposition from many of the affected cities.

Senate Bill 227 seeks to create a workaround the on $10,000 cap on state and local tax deductions that came about as a result of the federal overhaul of the tax code earlier this year. The bill would allow for Californians to make contributions to school districts, charter schools, and community colleges in exchange for state tax credits, which could be fully deducted from their federal taxes.

Click here to read article.

by admin | Jun 12, 2018 | Market Updates, Real Estate Trends

The most anticipated new housing community in the Sacramento region goes “vertical” next week south of Highway 50 in Folsom with the construction of model homes, followed by homes for sale.

The project site is massive at 3,300 acres, just south of the freeway and north of White Rock Road, between Prairie City Road and the El Dorado County line. It will contain nearly 11,000 homes and apartments, three public schools, two fire stations, a police station and 82 acres of office and commercial buildings.

The community ultimately will house 25,000 residents, enlarging the city of Folsom by one-third. It will bring new home-buying opportunities, but also growth pains.

Click here to read article.

by admin | Jun 6, 2018 | Market Updates, Real Estate Trends

Huntington Beach Assemblyman Travis Allen, Republican: Allen has a goal for developers to build at least 1 million new homes in his first four years as governor. He believes the state needs to strip away many of the regulations around home building, which he says would allow developers to increase the housing supply. He doesn’t support subsidizing low-income housing, arguing developers will build for people of all incomes if taxes and fees are lower.

The Huntington Beach Republican is also opposed to a potential November ballot measure to allow for the expansion of rent control. He believes rent control leads to housing shortages and says he’d work to eliminate all existing rent control policies across the state.

State Treasurer John Chiang, Democrat: Of all the candidates, Chiang is calling for the most government spending on housing. He would set a goal for the state to help finance 1.6 million homes for low- and moderate-income Californians from 2019 to 2030. He has also proposed a future $9-billion bond measure to subsidize new low-income construction, property tax breaks for developers who agree to set aside part of their projects for low-income families and additional tax revenue to cities that approve more housing.

Chiang is opposed to the potential rent control ballot measure, and believes that the state could change Costa-Hawkins, the law prohibiting the expansion of rent control, to allow for its broader use in certain circumstances.

Businessman John Cox, Republican: Cox, who owns a real estate investment and property management company, has a goal for developers to build 3 million new homes over the next decade. He said that the state needs to reduce regulations on builders, including replacing its primary environmental law governing development, the California Environmental Quality Act, with a less comprehensive measure. Cox also wants to allow Californians to be able to take the property tax benefits they receive under Proposition 13 with them when they move. In addition, Cox is against a potential November ballot measure to help rent control expansion.

Former state schools chief Delaine Eastin, Democrat:Eastin would set a goal of developers building 1 million new homes in her first four years in office, and would prioritize construction around transit hubs. She wants to rezone a lot more land for housing, including current commercial properties, increasing land available for duplexes and townhomes, and making it easier to build homes on smaller lots.

Of the top candidates in the race, Eastin has been the most supportive of expanding rent control as well as advocating for the repeal of the Ellis Act, which allows for the eviction of rent-controlled tenants if landlords convert their buildings to for-sale condominiums.

Lt. Gov. Gavin Newsom, Democrat: Newsom wants developers to build 3.5 million homes from when he takes office through 2025, which would be an unprecedented building boom compared with modern California history. He wants a fivefold increase in a state tax credit to finance low-income housing, bringing the state budget cost to $500 million a year. And Newsom supports eliminating regulations that he contends make it difficult for developers to produce middle-income homes.

Newsom is against the potential rent control ballot measure and believes that the Costa-Hawkins law should be changed to add more renter protections.

Former Los Angeles Mayor Antonio Villaraigosa, Democrat: Like Newsom, Villaraigosa calls for building 3.5 million new homes through 2025. He wants to create a new version of a program that allows cities and counties to set aside some property tax dollars to help finance low-income housing. And he plans to set up a $10-billion revolving loan fund to help homeowners convert garages into separate houses or build stand-alone second units in their backyards.

Villaraigosa is against the potential rent control ballot measure and says that he would use potential changes to Costa-Hawkins as a bargaining chip in a larger package of policies to address housing affordability.

Click here to read article.

by admin | May 24, 2018 | Market Updates, Real Estate Trends

More people are moving into Merced County and the housing market is having trouble keeping up with the growth.

The California Department of Finance reported that the county is the fastest growing in the state. The report showed that more than 4,000 people moved into Merced County last year. The state department shows the county saw a 1.8% population increase since the start of 2017.

Merced County’s population is projected to grow by nearly 68 percent between 2015 and 2060, reaching 452,519 residents. If the state’s estimates prove accurate in other parts of the state, Kern will overtake Fresno in the 10th most populated county by 2052.

Krotik says a big part of it has to do with the growth of UC Merced. About 1000 apartment units are being built in the city of Merced. County officials are working to accommodate the influx of both people and businesses.Another factor is affordability. Los Banos saw the most people moving in with more than 900 new residents. Real estate agents claim most of them are from the Bay Area.

High housing prices along the coast and in the north part of the state – and a reluctance to build more there to meet the demand – will continue to push more people inland, including those who live in the Valley but commute for better-paying jobs

A strong market it’s a good problem to have, but low vacancy will remain a problem until more homes are built to meet the needs of a growing county.

Click here for more information.

by admin | May 22, 2018 | Market Updates, Real Estate Trends

The Most Expensive

-

San Francisco, CA rent, similar to last month, remained at $3,400 and as the most expensive in the metro.

-

Mountain View, CA was second with rent climbing $10 to $3,110.

-

Emeryville, CA ranked as third with rent at $2,790.

The Least Expensive

-

Vallejo, CA rent dropped $70 to $1,420 and continued to be the least expensive.

-

Santa Rosa, CA was second with one bedrooms priced at $1,570.

-

Napa, CA ranked as third with rent falling $50 to $1,650.

Growth rate, Yearly 1 Bedroom Rent Evolution

The Fastest Growing (Y/Y%)

-

Emeryville, CA had the fastest growing rent since this time last year, up 15.8%.

-

Mountain View, CA was close behind as second with rent climbing 15.6%.

-

South San Francisco, CA ranked as third with rent jumping 14.5%.

Click here to read article.

by admin | May 10, 2018 | Market Updates, Real Estate Trends

Through shifting control of land use policy from local to regional governments, Senate Bill 827 wants to reduce the Golden State’s cost of housing.

State Senator Scott Wiener, the movement’s champion in the California Senate, has proposed a new bill SB 827, that, if passed, would compel California cities to allow dense, mid-rise housing within walking distance of most transit. The bill would affect large swaths of Los Angeles, San Francisco, and Oakland, and other locations farther afield, near rail stations and along bus routes. If SB 827 passes, it would be the most important step in decades toward upping the state’s housing supply in substantial numbers.

Opponents of the bill portray it as seizing control over neighborhoods from local planners, and they are not entirely wrong. The bill shifts power over an important aspect of land use policy from local decision makers to the state. Indeed, that is the proposal’s greatest strength.

SB 827 shifts power over an important but specific aspect of land use policy—housing density near transit—from the local level to the regional one. Moreover, it does so without otherwise intruding on cities’ autonomy. There is no need to over-constrain local land use policy by overriding it even when its effects don’t transcend municipal boundaries. Of course, the devil is almost always in the details and it certainly will be in the case of SB 827 too, but in shifting control over a defined aspect of land use from the local level to the regional one, this bill gets the overarching principle right.

Click here to read article.

by admin | May 4, 2018 | FHA Appraisals, Market Updates, Real Estate Trends

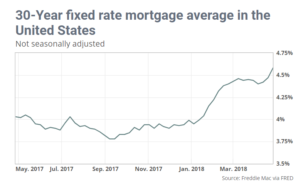

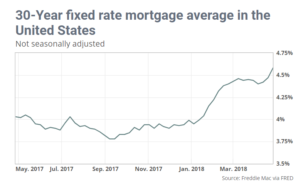

Mortgage rates surged to their highest level in almost five years this week.

Unlike the extremely mild and uneventful day-to-day changes seen for most of the past 2 months, rates are actually putting some distance between themselves and the March plateau.

Whereas a well-qualified borrower with 25% down may have been quoted a conventional 30 yr fixed rate of 4.5% a few weeks ago, they’d already be looking at 4.75% today for most lenders. Of course this can vary a bit from lender to lender, but the point is that all lenders have experienced that sort of delta.

Today’s Most Prevalent Rates – 4/26/2018

30YR FIXED – 4.58%

FHA/VA – 4.25%-4.5%

15 YEAR FIXED – 4.02%

5 YEAR ARMS – 3.74%

To see full article click here.

by admin | Apr 24, 2018 | Market Updates, Real Estate Trends

New residents to the Bay Area are earning far more than the people they’re chasing out, pushing up home prices and highlighting the gap between owners and renters in Silicon Valley. Lower income workers moving out of the Bay Area were being replaced by younger workers making about $12,640 more annually from 2005 to 2016, according to a national study released by BuildZoom. The Bay Area income gap has accelerated from 2010 to 2016, with the average newcomer out-earning the typical former resident by about $18,700. Bay Area newcomers had a median annual household income of about $70,000, while those leaving had a household income of $57,400. About 60 percent of the newcomers had at least a four-year college degree, while about 50 percent of the outgoing residents had that level of education.

The Bay Area represents the extreme edge of a national trend: higher paid and educated professionals moving to large, coastal cities like San Francisco and New York, while lower paid workers are moving toward less expensive metro areas. This migration has driven up housing prices in coastal cities, while others in the Rust Belt have seen home prices drop.The median sale price for a single-family home in prime Bay Area counties has climbed for nearly six years. The median price for a home in Santa Clara County in February was $1.3 million, in Alameda County $750,000, in San Mateo County $1.45 million and San Francisco $1.5 million, according to real estate data firm CoreLogic

by admin | Apr 18, 2018 | Market Updates, Real Estate Trends

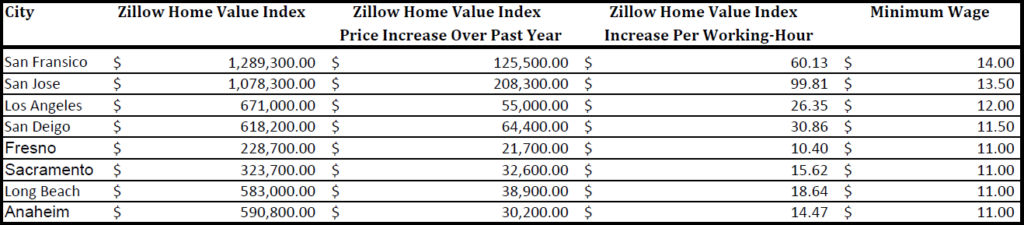

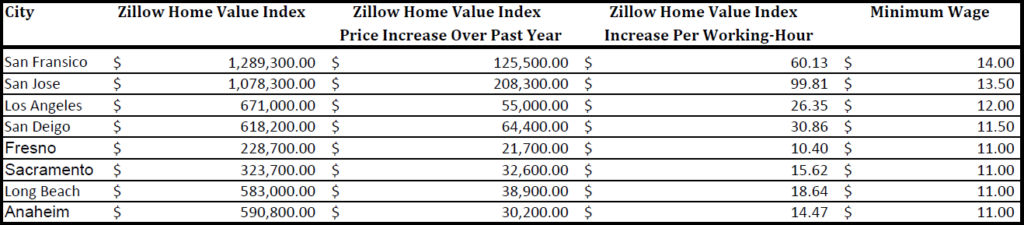

Houses in San Francisco earn more per hour than most of their owners – or anyone else, for that matter, – do at work, a new report finds.A study released by real estate site Zillow finds that houses in the Bay Area city typically appreciate at a rate of $60.13 for each working hour, calculated based on a 40-hour work week. Minimum wage workers in San Francisco currently take home $15 an hour and the average hourly wage in the San Francisco-San Mateo metro area was $36.61 in 2016, reported the U.S. Department of Labor.

In San Jose, the typical homeowner is gaining $99.81 of equity in their home every working-hour, but minimum wage in the city is just $13.50. That means the typical home in San Jose is “earning” over seven times local minimum wage. Even still, the average hourly wage in the San Jose metro is $43.71, which is over two times less than local home value appreciation per working-hour.

San Francisco and San Jose are poised to be among the most expensive markets in the nation throughout 2018, reported Zillow, with median home values of $1.1 million in San Jose and $893,000 in San Francisco. A renter or prospective buyer would need to earn at least $170,000 a year to live comfortably in either market, according to HSH.com.“The way the economy in the Bay Area is right now, it’s like the demand is on steroids,” Michael Rawson, director of the Public Interest Law Project based in the Bay Area, told Newsweek. “It drives the land prices through the roof.”

Click here to read full article.

by admin | Apr 12, 2018 | Market Updates, Real Estate Trends

A house that suffered major fire damage two years ago is on the market for $800,000 in San Jose, California. The listing, which has already attracted criticism online, would appear to be a clear example of Silicon Valley’s overheated housing market.

But the realtor behind the sale has defended the asking price, telling local media that the area and the land itself warrants it. The dilapidated and boarded-up house sits on a 5,800 square foot lot in San Francisco’s Bay Area, home to some of the country’s largest tech firms and start-ups. According to real estate company Zillow, the median home value in San Jose is $1,078,300. That’s up 23.9% over the past year, and is predicted to rise 8.4% over 2018. The fact that severe fire damage only bumped that average down to $800,000 says a lot about the area’s market, where available housing is sparse and residents prioritize proximity to their employment.

A post Monday on the Willow Glen Charm page on Facebook lists a $799,000 asking price. Barr told KTVU she’s already received at least 10 offers and expects to sell the property in the next few days.

Click here to read the full article.

Page 2 of 7«12345...»Last »