Pacific Appraisers

May 4, 2018

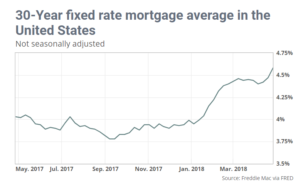

Mortgage rates surged to their highest level in almost five years this week.

Unlike the extremely mild and uneventful day-to-day changes seen for most of the past 2 months, rates are actually putting some distance between themselves and the March plateau.

Whereas a well-qualified borrower with 25% down may have been quoted a conventional 30 yr fixed rate of 4.5% a few weeks ago, they’d already be looking at 4.75% today for most lenders. Of course this can vary a bit from lender to lender, but the point is that all lenders have experienced that sort of delta.

Today’s Most Prevalent Rates – 4/26/2018

30YR FIXED – 4.58%

FHA/VA – 4.25%-4.5%

15 YEAR FIXED – 4.02%

5 YEAR ARMS – 3.74%

To see full article click here.