Pacific Appraisers

December 16, 2014

Single Family Residential Report

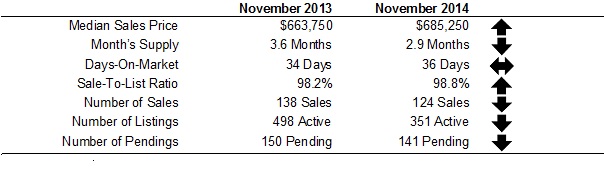

The median value for single-family homes in Santa Cruz County took a slight dip from last month, but is still above the November 2013 median value. The following is a snap shot of recent market statistics covering the single family housing market in Santa Cruz County. The analysis presents a broad-brush overview of market indicators such as median sales price, month’s of inventory, and sales volume.

Median Sales and List Price

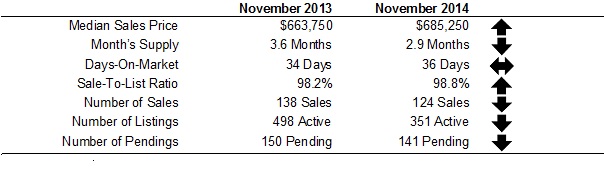

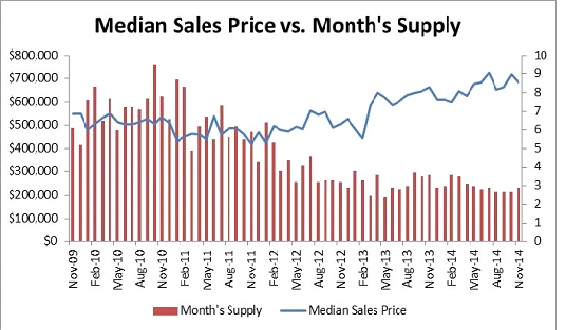

The median selling price of a Santa Cruz County single-family home increased last month on a year-to-year comparison. The median sales price of such a home was $663,750 in November 2013 versus $685,250 in November 2014, a boost of 3.2%. Last month, the median sales price was $716,615.

Source: MLSListings.com (As of 12/11/2014 )

Month’s Supply

The inventory of active listings has long been a vital leading indicator of housing market dynamics. Ultimately, the inventory ratio provides the best predictor of near-term market direction and one of the major keys to understanding price shifts in the market.

There was a 2.9 month supply reported in November 2014. This is down from last year and below the historical average of approximately 6.0 months. At three months of inventory, the median sales price will likely continue to climb.

Days-On-Market

Another indicator of market dynamics is the number of days a property is on the market prior to being sold. As demand increases and supply shrinks – the time it takes to sell a property will decrease. For days on market, the median tends to be a better indicator as the average can easily be skewed.

Source: MLSListings.com (As of 12/11/2014 )

Historically, days-on-market for a home in Santa Cruz County ranged from 15 to 128 days, and averaged 47 days. Currently, the November 2014 median days on market is 36 days, comparable to the 34 days reported in for the same time period last year.

Sale-To-List Ratio

Limited supply and pent up demand will tighten the ratio of sale to list price. Historically, sellers have been able to command approximately 98.0% of asking. The November 2014 sale-to-list ratio is 98.8%, which is just slightly above the 98.2% reported in November 2013.

Number of Sales and Number of Active/Pending

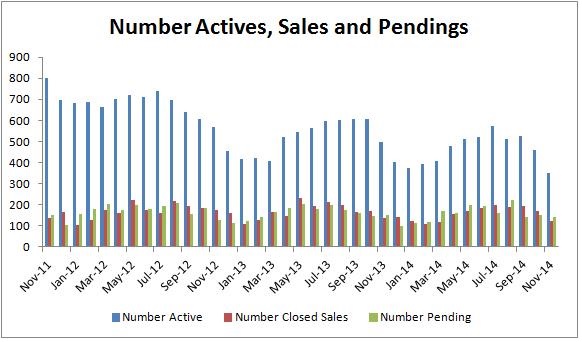

The volume of single-family home sales was down slightly. Last month, 124 single-family homes were sold in Santa Cruz County, compared with the 138 sales in November 2013; a decrease of about 10.1%. Active and pending homes have seen a more significant jump. In November 2014, there were 351 active listings compared to the 498 reported in November 2013. The decline reflects a shrinking inventory, but also is indicative of the winter cycle.

Conclusion

For those of us in the real estate market, it comes as no surprise that there is a seasonal pattern to home sales data. In general, the changes that we’re seeing are typical for a winter pattern. Values appear to be stabilizing somewhat in the Santa Cruz County market. The year-over-year growth for November was 3.2%, and month’s supply has been on the rise. As of right now, the current market activity supported by historical trends suggests slow but modest price increases in the Santa Cruz County single family residential market.